MEMBER LOGIN

A Little Relief Goes A Long Way

April showers bring more than just flowers—they’re the perfect time for a budget refresh! Skip a payment this month and enjoy some relief. Whether you’re preparing for a spring getaway, tackling home improvements, or simply want to boost your savings, we’re here to help you breathe a little easier.

Applications accepted March 1 through March 20, 2026.

To skip your loan payment for April 2026, simply complete the Skip-a-Payment Request Form*.

A small processing fee of $35 applies per loan

Skipping a payment extends your loan term and changes your final payment amount

Interest continues to accrue during the skipped month

Please note: This offer is available only to members in good standing (at least six months of payments on each loan, no delinquency, and no overdraft limit exceeded).

Want to learn more or apply? Contact us if you have any questions, or complete the online form.

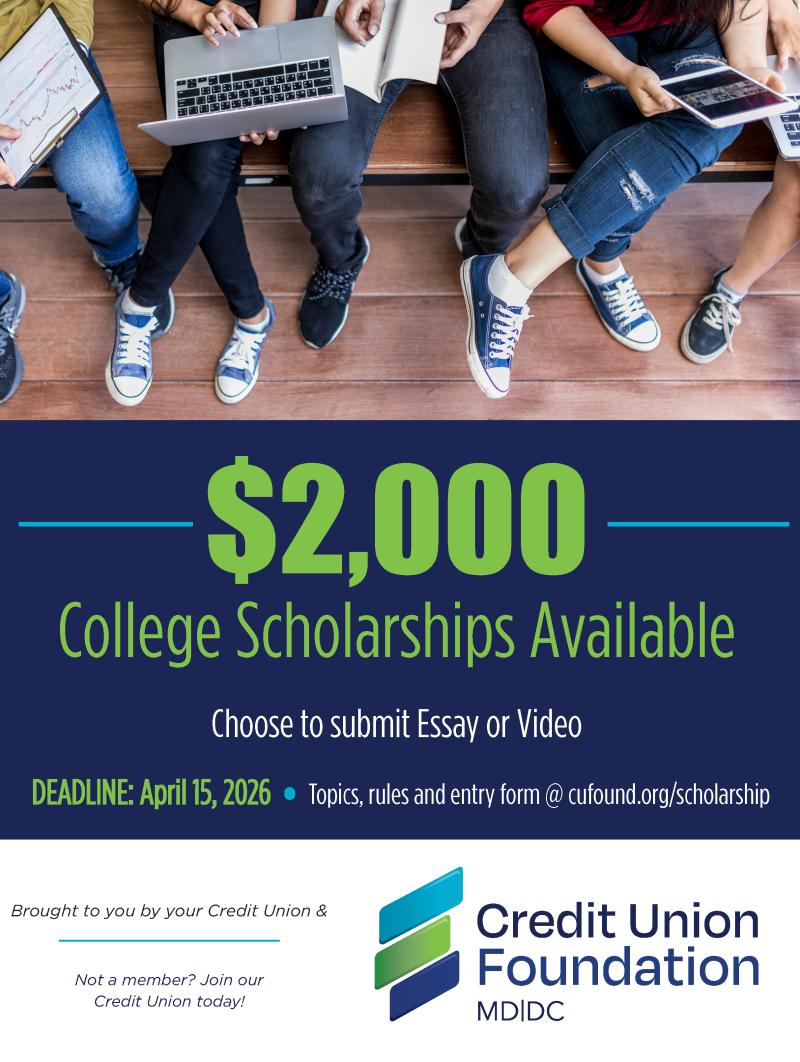

CU College Scholarship Available

Applicants for 2026 Scholarships Are Now Being Accepted

Ready to fund your education? The 2026 Credit Union Scholarship Program is now open and offering $24,000 in scholarships! Open to college-bound individuals; applicants can vie for ten $2,000 essay-based and two $2,000 video-based scholarships, with eligibility for members of affiliated credit unions in Maryland, D.C., or part of MD|DC Credit Union Association.

Deadline for applications is April 15, 2026, at 11:59 pm. Scholarship winners will be announced in June 2026.

2026 Essay Topic: Credit unions play a significant role in promoting financial wellness among their members. How do you believe credit unions contribute to the financial health and stability of individuals and communities? Discuss specific benefits and provide examples or personal experiences to illustrate their impact.

2026 Video Topic: Create a 60 second video depicting how credit unions contribute to the financial health and stability of individuals and communities.

Any member of GPO FCU entering their freshmen through senior year of college or trade school may apply.

“We’re pleased to offer this opportunity for our young members,” said Stephanie Covington CEO at GPO FCU.“The awardees receive needed financial assistance to help them meet their tuition expenses and the application topics stimulate innovative and useful responses to help us better serve our college-aged members.”

Applications are accepted online at:

https://cufound.org/consumer-resources/apply-for-scholarships/.

GPO FCU, the Credit Union Foundation MD|DC, and its generous supporters cooperate to make this scholarship program possible.

Government Furlough Quick Facts

Emergency Furlough Relief assistance

GPOFCU is here for you

We care about our members and offer special programs to help families cope with government furloughs. Members can apply for the following emergency relief options when a Government Furlough happens.

Skip a Payment: You could receive a 1-month skip payment* on qualifying loans3 if you are affected by the furlough. Please email lending@gpofcu.org to inquire about the Skip a Payment program.

Government Furlough Loan: You could qualify for a no-interest loan** up to $4,500.00 if your payroll is directly deposited into your GPOFCU account.

Additional loan assistance: If your pay is not directly deposited into your GPOFCU account, upon credit qualification, you could receive a Lifestyle loan with rates as low as 7.75% by applying at www.gpofcu.org.

Disclosures

*Members must provide a current pay stub and a copy of the furlough letter to verify they are directly impacted by the shutdown. ** Available for up to one month’s net pay for a maximum term of 6 months. The interest rate is currently 0% APR. Advance(s) must be repaid within 10 days of receipt of the direct deposit to ensure the advance remains at 0% interest. Members must qualify for credit under GPOFCU guidelines.

Visa Promo

Make your spending easier with a Visa® Credit Card — designed for smart savings and convenience.

9.90% APR Fixed Rate*

Enjoy a low, fixed rate that lasts all year.

Card Benefits:

No Annual Fee

No Balance Transfer Fee

25-Day Grace Period on Purchases

Convenient Online Account Access

Foreign Transaction Fees May Apply

*APR = Annual Percentage Rate. Rate may vary based on creditworthiness. Not all applicants may qualify for the advertised rate. Late payments may result in fees and could affect your APR. Minimum monthly payments are required. See the Credit Card Agreement for full terms and conditions.